What supply chain issues are being faced in Network Engineering?

24 Aug, 20233 minsUncertainty about the length of backlogs for IT hardware means both vendors and enterprises ...

Uncertainty about the length of backlogs for IT hardware means both vendors and enterprises are changing their purchasing strategies.

A perfect storm of the COVID pandemic, rising inflation and the war in Ukraine, has played havoc with the supply of raw materials critical to the IT industry.

The first half of 2022 saw 46 per cent more supply chain disruptions than the first half of 2021 according to Network World.

One of the biggest issues has been chip shortages caused by unprecedented period of disruption for the semiconductor industry in particular.

So why are semiconductors so important?

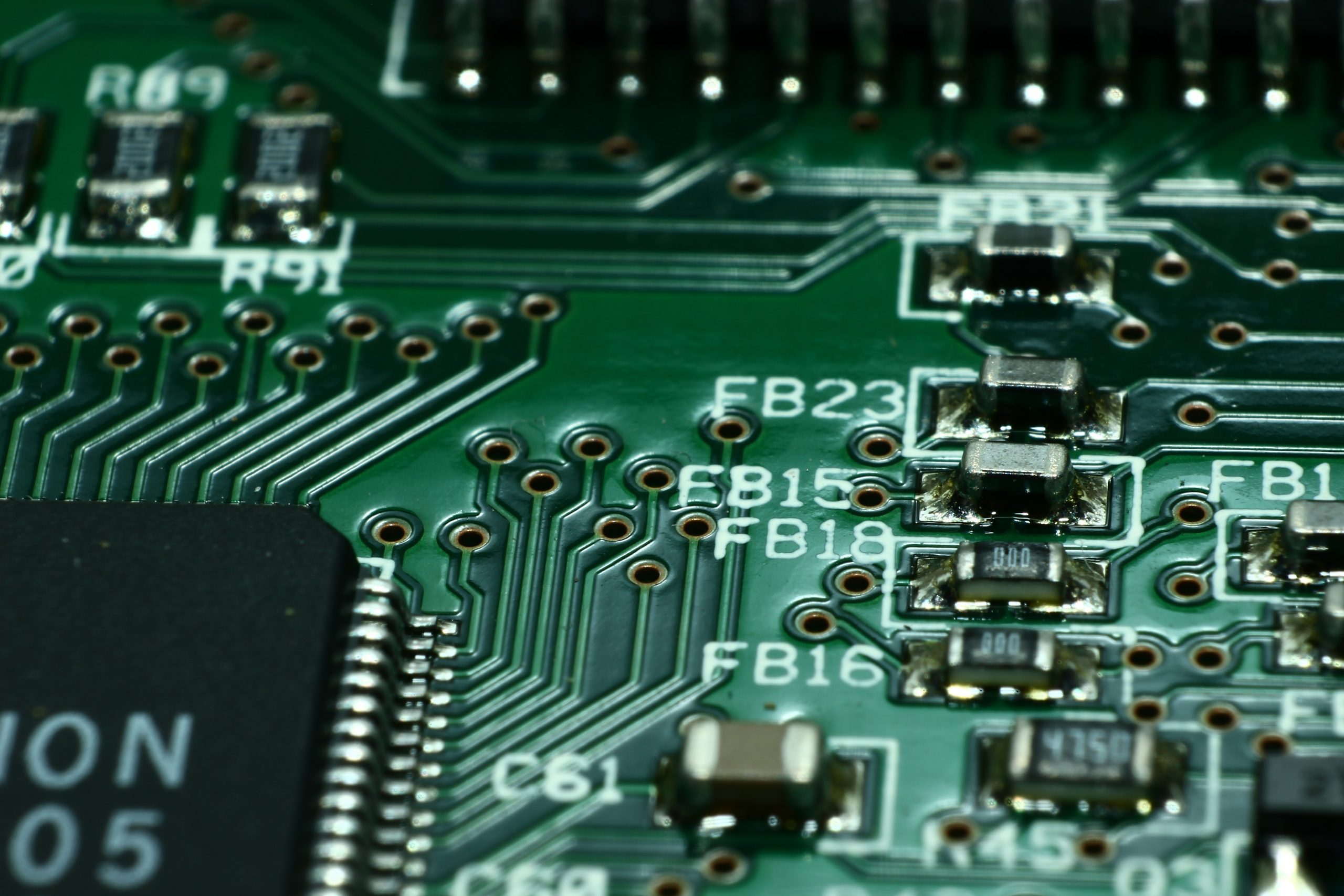

A semiconductor is a substance that has specific electrical properties that enable it to serve as a popular component of electronic chips made for computing components and a variety of electronic devices.

Today, nearly all modern electrical devices use semiconductor chips, from home ovens to smartphones and cars. Billions of semiconductors are manufactured each year, and they are getting smaller and smarter with each generation.

Whilst demand for the chips remains sky-high as networking is becoming increasingly critical to every organization, led by digital transformation, hybrid cloud, AI, and ML workloads, supply is unable to keep up, causing major backlogs in supply chains. Cisco alone found itself facing a $14 billion backlog thanks to component scarcity.

Vendors whose usual lead time for a piece of kit would be three to four weeks have been quoting 18 months to two years – a date which is often pushed back even further throughout the period. Sometimes the kit has even become delisted – by the time there are enough chips to start supplying, the development has moved on, and it’s now old technology.

These shortages have impacted the job market too. For example, imagine having a sales job where everything you’re selling is unavailable for two years, meaning you will not receive even a whiff of commission until it goes through. It erases the appeal of such roles, so some have likely moved out of the industry altogether.

What is the UK government doing about it?

The ongoing supply constraints have finally prompted a response from the UK government, who unveiled a new £1 billion strategy for the UK's semiconductor sector in June.

‘The National Semiconductor Strategy’ as it has been named, sets out how the UK will build on industry strengths, safeguard supply chains from disruption and protect tech against national security risks.

While companies in the sector have largely welcomed the publication of a strategy, many have criticised the scale of support with Britain's plan dwarfed by the $52.7 billion of U.S. chip subsidies and €43 billion ($47 billion) of proposed EU investment.

Some also remain sceptical as to whether the move will run deeper than simply a token gesture and will be eager to see how much of the money will filter through to where it is needed most.

Despite this, for businesses who have been facing severe chip shortages, any measure that might alleviate even the tiniest percentage of that disruption will likely be welcomed, simply due to the sheer scale of backlog.

How can backlogs be improved in the long run?

Global supply is showing signs of improvement; between 2021 and 2023 the industry is projected to invest more than $500 billion in 84 volume chipmaking facilities.

However, for the UK, steps need to be taken to protect against supply fluctuations in the longer term.

George Barnes, our CEO, believes the key lies in bringing the manufacturing of chips ‘in-house’ in the UK. Whilst there are plenty of microchip and semiconductor startups, predominantly based around Oxford and Cambridge, there should be a greater focus on building the chips, rather than simply innovating for the rest of the world.

And it seems that things are moving in the right direction.

Government investments and industry partnerships are fostering a return to onshore manufacturing, with significant investments in local manufacturing. A combination of government and private investment in domestic semiconductor manufacturing should help reduce the potential for supply chain disruption.

Some businesses are also changing the way that they are structuring their supply systems with some diversifying their lines of supply and 64 per cent of companies moving from a just-in-time supply chain to a just-in-case supply chain, to safeguard systems against similar future disruptions. Moving processes to the cloud where possible will also help to mitigate risk.

For future supply chain protection, experts argue that transparency also needs to be prioritised. Many believe that visibility has worsened since the start of the pandemic, with some suppliers not being transparent about problems or trying to make them look more minor than they are.

But ignorance is not, in fact, bliss and will instead result in longer term issues as businesses being unable to proactively mitigate against disruption and instead finding themselves limited to reactive problem solving. For manufacturers in particular – it’s crucial that they know if supplies are on track, or if alternate sources have to be found in order to avoid production delays.

If UK semiconductor production is to be increased, not only will consistent funding be required, but so will a job force able to sustain it.

Interested in being part of an innovative and fast-moving industry? Get in touch with one of our experts today.